01.06.2022

CHANGE

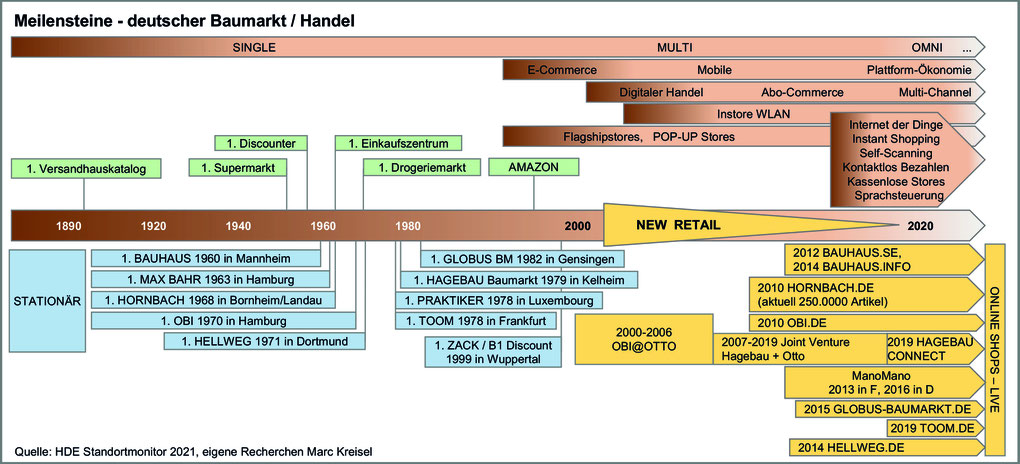

E-commerce has turned the retail world upside down. Shopping is convenient; customers buy when and where they want. But the transformation in retail is continuing, and the DIY industry is no exception. A well-known German comparison portal is currently setting up the DIY segment and is in talks with suppliers and DIY stores. The pandemic was the accelerator for digital transformation in the DIY market. With the ManoMano marketplace, an online pure player has entered the market. HORNBACH has invested high sums in its Interconnected Retail program and has arguably not only created the best web store in the sector, but also established a very good link to their existing stores (similar to IKEA). Moreover, many new store format ideas are being tested and rolled out.

THE DIY STORE OF THE FUTURE ...

... will be small or medium or large; it will be analog and necessarily digital at the same time; it can be flexibly permanent or temporarily pop-upped, so also thoroughly mobile. In any case, the DIY store of the future will be hybrid and very close to customers and their needs.

The retail world is changing faster the more digital it becomes. It is also a fact that the DIY store of the future must be very close and visible to the customer. The DIY store of the future will offer its customers exactly the product range they need - at the right time, in the right quantity and quality, with as little effort as possible for the customer, and of course at a good price point.

And even if online sales are growing steadily across the retail sector as a whole and already account for 12% in 2020 (German DIY/garden segment 7.1% Source: IFH), pure online business for DIY articles will tend to be limited. Shipping large and heavy items such as building materials, wood, flooring, or prefabricated construction parts directly to private end customers will always involve additional costs; the heavier, the bigger, the more expensive. The Click&Collect service, on the other hand, is free of charge for the customer. The customer's trip to the traditional DIY store to reduce project costs therefore makes perfect sense, especially for logistically more complex products.

RAPID EXPANSION BASED ON DIFFERENTIATION AND COMPETENCES

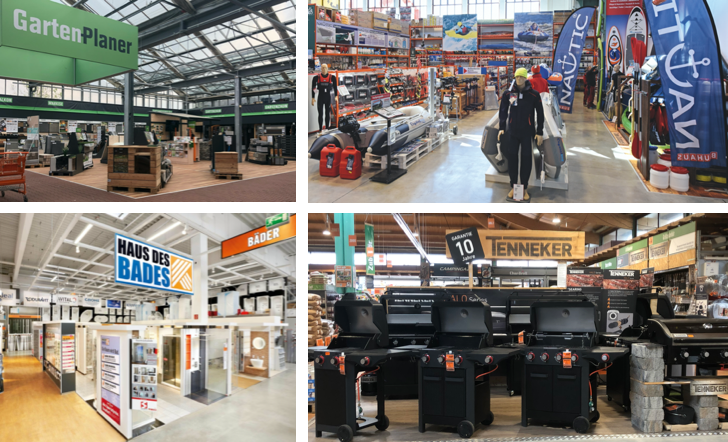

If a DIY retail group with large stores and reduced density wants to shorten travel times for project customers and at the same time fish in its competitors' terrain, then the web store alone will not be enough. BAUHAUS, HORNBACH, HAGEBAU, GLOBUS, OBI and TOOM stand for great DIY and garden center competence. Each of those retailers has key areas of expertise and well-developed shop-in-shop systems. So why shouldn't BAUHAUS or HORNBACH extract their competence departments, such as the their bathing competence centers BÄDERWELT / HAUS DES BADES, or OBI its garden competence format GARTENPLANER, or a flooring department into their own specialist store? Of course with a docked pick-up center for the ordered goods from the more than 200,000 articles in the webshop! Even for the professional, a shorter trip time to the nearest pick-up center would be very valuable.

And why shouldn't BAUHAUS open its NAUTIC boat accessories department as a singular professional shop close to all relevant sea, lake and river spots?

Different departments that would probably also work stand-alone:

- Hornbach House of Bath

- Bauhaus Nautical

- OBI Garden Planner

- TENNEKER BBQ Shop

The specialty trade - whether STRAUSS, FRESSNAPF or ZOOKÖLLE - could get competition with the new small specialized trade sales forms - let's call them competence fragments; one or the other DIY market does have strong private label concepts.

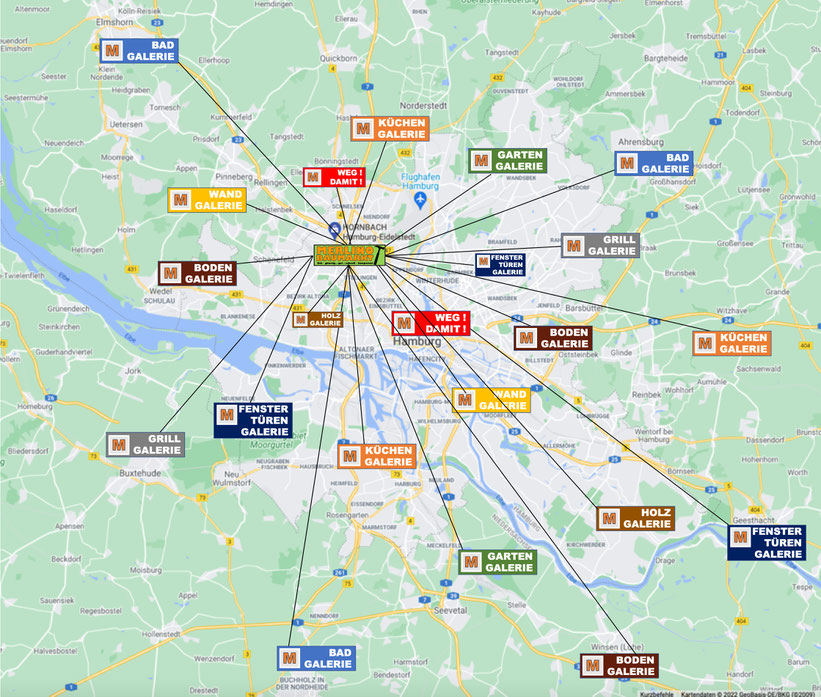

Could HORNBACH benefit from rollout of its competence departments to smaller specialist store centers with docked collection warehouses?

May be in previously poorly covered large cities, such as Hamburg?

To become the number 1 in Hamburg?

With a separate logistics center in the Hamburg area to guarantee a fast Click&Collect service?

FRAGMENTATION FOR RAPID EXPANSION

The filleting or fragmentation of a big boxes into competence centers seems to make sense insofar as it can be used to generate a dense network of many contact points in a city. The retailer is virtually omnipresent and also demonstrates individual competencies. With a large logistic distribution center outside the city, or by using the nearest large format as a distribution center; that could be a local satellite system with logistics intelligence for the smaller formats.

I firmly believe that the winner will be the DIY retailer that is NEARER to the customer - with an understanding of local needs and knowledge of how customers implement projects at home.

Moreover, there aren't really many suitable locations for big boxes anymore. This 'expansion light' also significantly reduces the time-consuming authority permits and processes required for large-scale projects. A big city can therefore be conquered even more easily with just one (or none) destination store.

THE NEARNESS STORE FORMATS IN THE DIY MARKET

And what is happening in the DIY market? As already mentioned, some things are being tried, but some are also being scrapped. The smallest areas in the inner city locations of JUMBO and LEROY MERLIN are working extremely well. HORNBACH is expanding with smaller project DIY stores in Sweden and testing a flooring format (BODENHAUS) in Germany, and in the Netherlands the HORNBACH VLOEREN concept extracted from the Kerkrade store.

TOOM worked for a few months in 2018 with the temporary pop-up stores STADTGRÜN and STADTBUNT. The OBI CREATE concept store has been in the heart of Cologne since 2019, and in Hamburg the much-acclaimed HORST urban DIY store has already been open since 2018, but without yet having another sibling in another city.

Pictures right / left:

The urban concepts of HORST and Jumbo

HORNBACH VLOEREN

In November 2021, HORNBACH VLOEREN will open in Kerkrade - a specialist store for floors of all kinds up to industrial flooring. By the way also well described in the DIY magazine 07/22

Very smart: the recent cooperation between MANOR and DÉCATHLON in Switzerland. MANOR is testing a shop-in-shop unit of Décathlon in its stores as well as selling DÉCATHLON items on its online marketplace. This is WinWin - DÉCATHLON is expanding rapidly with new locations (PROXIMITY!) and MANOR will surely benefit from the increasing customer frequency and a different Reason-Why.

Left:

The small city center format of Décathlon Connect in Berlin.

Right:

The REWE test store "Josefs Nahkauf Box" in Pettstadt: Innovative supply for places in rural areas.

24/7 and cashierless

To explore NEARNESS further, it is worth looking at customer needs at different stages of life on the subject of construction, buildings and gardening.

TEMPORARY NEARNESS IN A NEW PROPERTY CONSTRUCTION AREA

Looking at the life cycles of a property and starting from the groundbreaking ceremony o a real estate to the first few months of moving in, you can already see the customer need. On the one hand, there are the craftsmen, who always have a demand for additional or missing material and usually need it at short notice. Temporary pop-ups or mobile units in new construction areas with a 2-hour delivery from the company's own nearest destination store - a sort of order and pick-up center built from containers - would save the craftsmen corresponding travel time and thus also working time / costs. These temporary pop-ups could certainly also offer a special service to the private customer (DIY people or gardener) in the first six months of real estate life.

The idea is not completely new, by the way. Leroy Merlin already worked many years ago with pop-ups in pre-Russian satellite building areas, where condominiums are usually sold undeveloped. However, that was long before a web-based click & collect system; moreover, the potential in Western European single-family housing estates is probably much higher.

TEMPORARY CONSULTING CENTER

In times of skyrocketing energy costs, there is an increased need for consulting services, especially for single-family housing developments built in the 60s and 70s (with DIY capable inhabitants). Here, too, a temporary pop-up consulting center is an ideal solution for possible energy-related DIY renovation. In the absence of in-house consulting expertise, cooperation with a local energy consultant can help.

TEMPORARY PROXIMITY AND NEARNESS CREATES AWARENESS AND VISIBILITY

Opening a new DIY store in a new region takes a lot of effort. Often, another retailer is already the learned target DIY store in this area. Publicizing the company's own new big box with its different product ranges, departments, services and specific highlights is a real challenge for the store and for marketing.

This opening can also be supported during the construction phase with a pop-up store, similar to what TOOM has already done with its stores in Cologne and Frankfurt. A rented store in the city with monthly changing highlights, different assortments - for example a grill month with a strong grill own brand or the entire grill assortment in the month of May/June? - in order to make the people at the new location already familiar with the highlights and the strengths. Virtually the long celebration of the pre-opening with the goal of getting to know each other. By the way, KINGFISHER has pre-celebrated the imminent opening of a new market in some eastern countries with sales booths at flea markets.

Innovative: TOOM Pop-Up-Stores

THE BRAND COMPANIES AND SUPPLIERS

In times before the Internet, there was little opportunity for the suppliers and brands to sell and engage directly with the end customer. Retailers were in much closer contact to customers.With the digital revolution, with AMAZON, with market places and (brand-owned) web stores, retail has changed drastically and intensified direct customer contact. For branded companies, digital NEARNESS and proximity with their own WebShop is a must.

But long before the Internet, there were already branded companies that built up close customer relationship with their own stores. And thus were able to control the entire value chain themselves in addition to sales via retailers. A good example outside of DIY: ADIDAS ultimately prevailed against INTERSPORT with its own stores at an early stage with its strong brand. Other examples are WMF and LEGO.

ADIDAS Flagship Store Shanghai

LEGO and WMF in Berlin

STATIONARY NEARNESS AND PROXIMITY FOR BRAND-NAME RETAILERS

No one knows how retail will develop over the next 30 years. No one knows which of the current DIY players will be the big winner, who will be the newcomer, or which innovative start-up will perhaps work even better for the customer. It therefore makes sense for a branded company to be omnipresent on all distribution channels. This also includes at least considering stationary (pop-up) areas - whether operated in-house, franchised or contracted.

Examples KÄRCHER and WEBER

Small stationary brand outlets - above all, this is also an opportunity for consulting-relevant building project providers and competent full-range retailers - always with the aim of underlining the brand competence. Of course, with all the new challenges for the brand owner, such as the choice of location or local marketing.

A competence center such as an ISOVER DÄMMSHOP (or the ISOVER Energy Saving Center in cooperation with other partners in the field of energy-related renovation) would certainly be in the spirit of the times and would probably also meet the customer need at the moment. Also a BOSCH power park or a VILLEROY&BOCH /GROHE bath studio are not absurd. Especially since VILLEROY&BOCH is already active in the Dining & Lifestyle segment with its own stores (& factory outlets). And it is not certain in which direction one its major German partner GALERIA will develop.

BOSCH, GROHE and Husqvarna,

deep DIY store competence transported in large shop-in-shop concepts.

There are many possibilities to get closer and NEARER to the contact points of the customer journey and to give the customer even more service to meet his/her needs. The topics of augmented reality, showrooming, or exclusive cooperation certainly also need to be examined separately.

The fact is that the standard of doing business has changed revolutionarily in the last 20 years. Some standards and rules are still valid, but even more important is the customer-centric willingness to change and a revolutionary out-of-the-box thinking. Disruption starts from the customer and there will certainly be market shifts as one or the other player adapts better and slides even NEARer to the customer.

"Most things remain undone. Glorious future!" (Ingvar Kamprad)

SUMMERIZED

- Small satellite formats offer the opportunity to get even closer an NEARER to the customer.

- Small satellite formats offer the chance of better visibility.

- Small satellite formats offer the opportunity for expansion that is difficult to achieve so quickly with the current big boxes.

- Satellite small formats offer the chance to face the powerful competition in a city.

- Satellite small formats offer the chance to clearly communicate differentiated competencies.

- Small satellite formats require well-chosen locations.

- Temporary NEAR-SITE small formats (pop-ups) to meet temporary customer needs and communicate assortment/topic competencies.

- Small formats do not replace existing destination store, but create more NEARNESS to the merchandise, NEARNESS to the services and more visibility for the brand.

- Brands with broad/deep assortment competence as well as suppliers with project/topic competence should establish their own direct sales formats (digital & stationary stores).

Many thanks to the German DIY Magazine.

The article is published in the magazine in 2 parts in the issues June & July 2022.

© Copyright - Marc Kreisel - 01.06.2022 - mk@marckreisel.de